If you have a web store with Jazva or want to set up a parent web channel, you will need to set up your sales tax. You can enable automatic or manual tax rates in Jazva.

Contents:

Overview

As you collect payment from your web stores, it’s important to collect the right amount of sales tax. Jazva makes it easy to ensure you collect the right amount of tax on every sale you make.

Tax rates are the actual percentage of a sale that will be collected for your tax reporting (e.g. 8%) in a particular jurisdiction. You can specify global, statewide or city-specific rates by zip code.

Tax rules define which tax rate applies to a particular customer's purchase. It allows the system to find the appropriate tax rate for a given customer and product tax class. For example, you can define a “Wholesale” customer class with a 0% tax rate, in addition to a “General Public” customer class linked to a different tax rate.

Setting Up Tax Rates

Jazva makes it easy to set up and maintain sales taxes. You can add tax rates manually, or you can have Jazva automatically maintain tax rates for United States regions.

- From the main menu, navigate to Setup > Financials and select Sales Tax.

- Select a Taxable Country, such as United States.

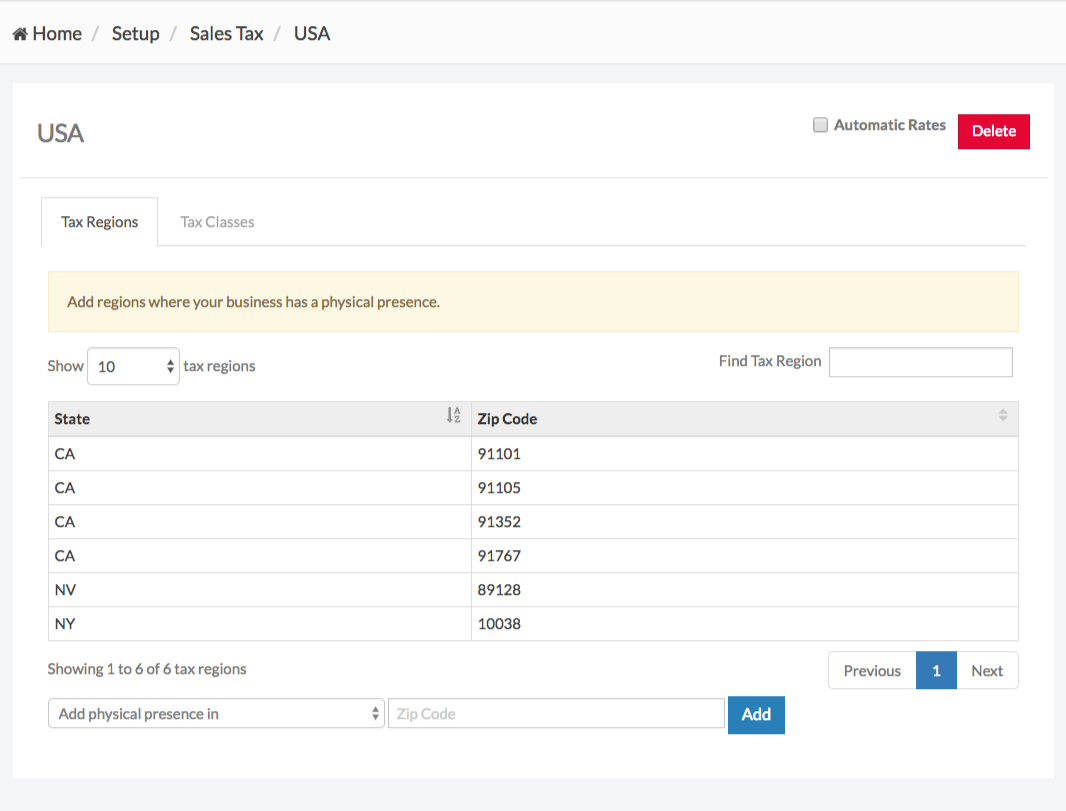

- From the Tax Regions tab, add a state and zip code where your business is registered. You can add multiple records if your business has presence in multiple regions.

- To enable Jazva to calculate tax rates automatically, simply select the Automatic Rates checkbox on the top right corner.

- To apply manual rates, make sure that Automatic Rates is unchecked and select a state.

- From the Manual Rates tab, click +Add Rate.

- In the dialog box, fill out the required fields:

- Name - name the Tax Rate you are creating (e.g. CA Sales Tax).

- Rate - enter the tax rate amount (e.g. 9.0).

- Shipping Included - Select this checkbox if the shipping charge is taxable.

- Customer Tax Class - select a customer tax class.

- Product Tax Class - select a product tax class.

- Zip Range - enter the zip code range this tax rate will be applied to. This can be used for instances where certain zip codes require a different tax rate.

- To enter multiple zip codes in a range, use a dash ( - ) between the first and last zip codes in the range. Example: for zip codes 94540 thru 94545, enter: 94540-94545

- To enter individual zip codes, use a comma ( , ) to separate the specific zip codes. Example: for zip codes 94540, 94831 and 94557, enter: 94540,94831,94557

- Click Save to complete setup.

Tax Rule Stacking

Please note that tax rules will stack on top of each other.

For example:

- If Tax Rule 1 has a rate of 10% for all of California,

- And Tax Rule 2 has a rate of 2% with a specified zip code 91101 in California,

- Then an order going to 91101 will be charged a 12% tax total.

Setting Up Tax Classes

In Jazva, you can set up two types of tax classes: Product Tax Classes and Customer Tax Classes.

- From the main menu, go to Setup > Financials and select Sales Tax.

- Select a Taxable Country and toggle to the Tax Classes tab

- You will notice two textboxes. One for Product Tax Classes and the other for Customer Tax Classes. You will need to enter tax classes in key;value format (e.g. Tax 1; For Retailers).

- Key is the tax class you use for internal reference

- Value is the label that will appear in the system going forward.

- Click Update to save.

- Congratulations. Your tax classes will now be available in the system.

Comments

0 comments

Please sign in to leave a comment.